Page last updated: 05 September 2024

Table of Contents

How many Chinese tourists visit Australia each year?

Over 681,000 Chinese visitors travelled to Australia in 2024 (year ending March 2024).

- This marked a 350% increase compared to the 151,000 visitors from China in 2023.

- However, it still represented a 49% decrease compared to the 1.3 million Chinese visitors in 2019, when China was the largest source of visitors to Australia.

- China was the second-highest source of visitors to Australia in 2024, following New Zealand.

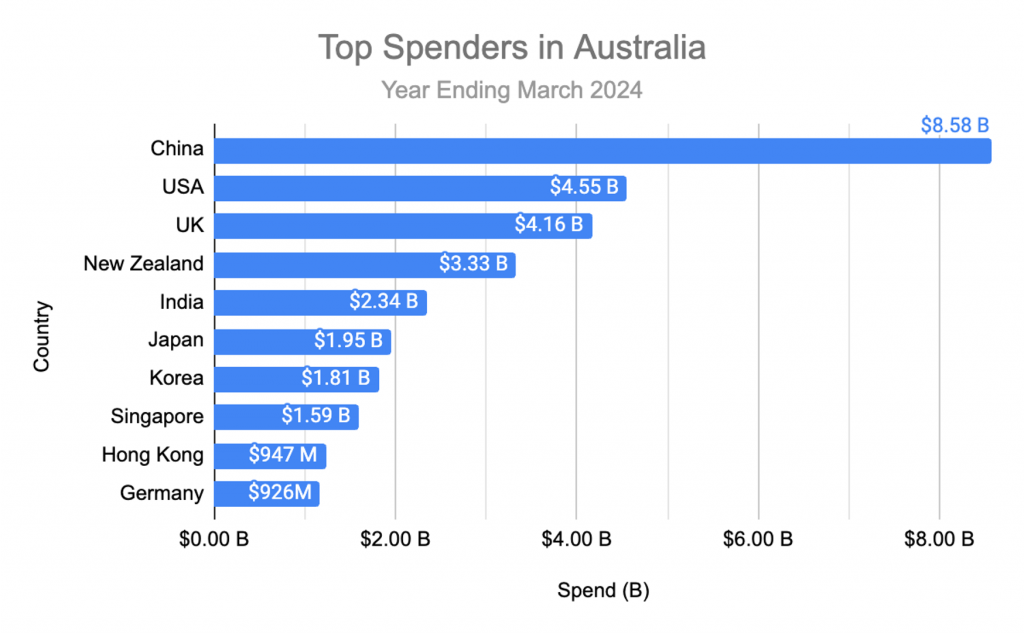

How much did Chinese tourists spend in Australia in 2024?

Chinese visitors spent approximately $8.58 billion during trips to Australia in 2024 (year ending March 2024).

- This marked a 163% increase compared to the $3.26 billion spent by Chinese tourists in 2023.

- Despite the increase, spending was still 28.3% lower compared to the $11.97 billion spent during pre-COVID 2019.

- Chinese visitors were the top spenders in Australia in 2024, maintaining their position from previous years.

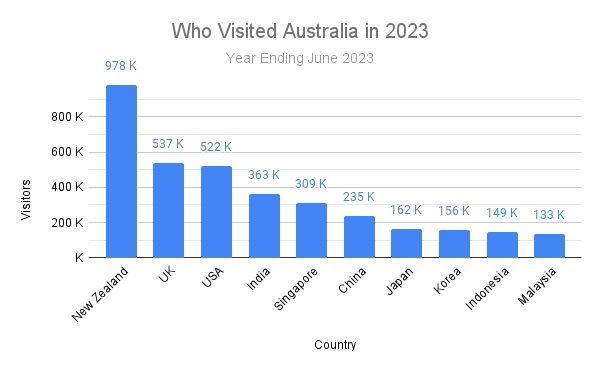

How many Chinese tourists visited Australia in 2023?

Over 235,000 Chinese visitors travelled to Australia in 2023 (year ending June).

- Visitors from China were up 571% when compared with the over 35,000 visitors in 2022.

- In 2019, China was the highest source of visitors to Australia, with over 1.4 million making the trip.

- China was the 6th highest source of visitors to Australia in 2023.

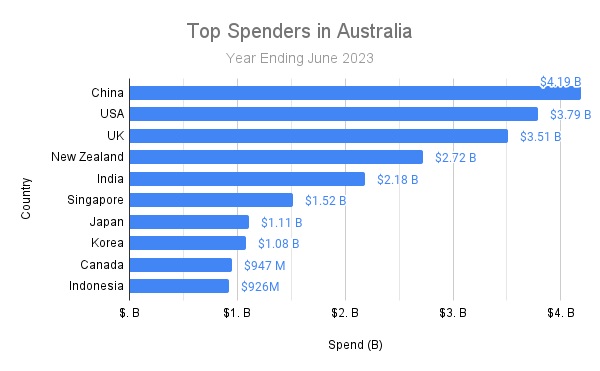

How much did Chinese Tourists spend in Australia in 2023?

Chinese visitors spent over $4.1 billion during trips to Australia in 2023 (year ending June).

- Spending was up 500% when compared with the $698 million spent in 2022.

- Spending is down 64.8% when compared with the over $11.9 billion spent during pre-Covid 2019.

- Chinese visitors were the top spenders in Australia during 2023.

How many Chinese tourists visited Australia in 2022?

Over 62 thousand Chinese tourists visited Australia in 2022 (year ending September 2022).

- Visitors from China saw an over 1700% increase when compared with the 3,359 visitors of the previous year (year ending September 2021).

- The increase is primarily attributed to the gradual lifting of travel restrictions beginning in November 2021.

- Before the pandemic, China was the leading source of tourists to Australia, with over 1.3 million making the trip in 2019 (year ending September 2019).

How much did Chinese tourists spend in Australia in 2022?

Chinese tourists were the top spenders in 2022, spending over $1.5 billion during trips to Australia in 2022 (year ending September 2022).

- Spending was up over 1800% when compared with the 77 thousand spent in 2021 (year ending September 2021).

- Chinese visitors have historically been the top spenders, with a record spend of over $12.2 billion in 2019 (year ending September 2019).

How many Chinese tourists visited Australia in 2021?

Over 3000 visitors from China travelled to Australia in 2021 (year ending September 2021).

- Visitors were down 99.7% when compared with the over 1.3 million in 2019 (year ending September 2020).

- The lower numbers can be attributed to the pandemic and covid related travel restrictions.

How much did Chinese visitors spend in Australia in 2021?

Chinese visitors spent 77 million during trips to Australia in 2021.

- Spending was down 99.9% when compared with the over $12.2 billion spent during 2019 (year ending September 2019)

How many Chinese tourists visited Australia in 2020?

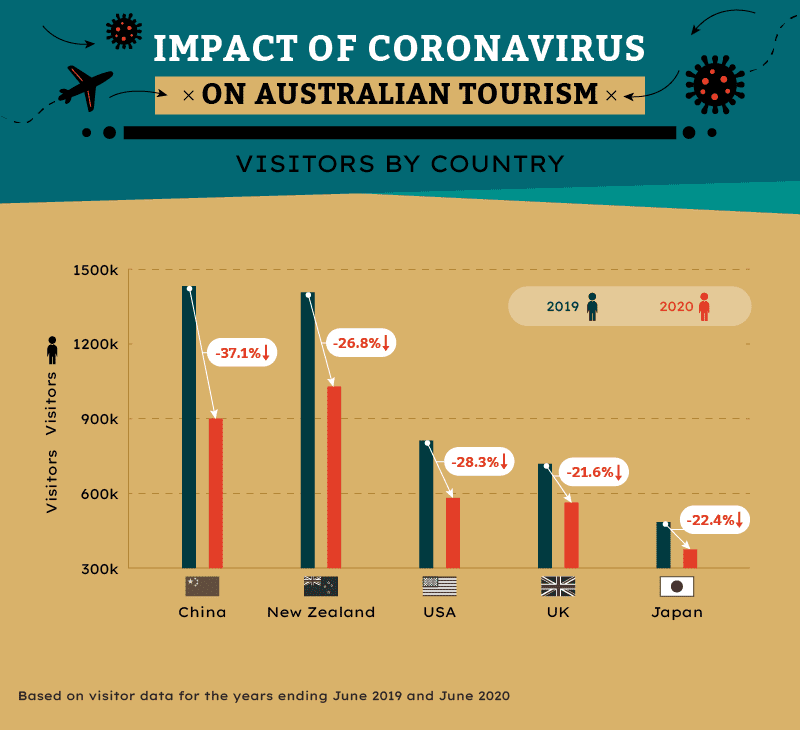

Over 207,600 Chinese tourists visited Australia for the year ending December 2020.

- Visitors from mainland China were down 85.5% when compared with the over 1.4 million visitors of the previous year.

- Prior to 2020, China had been the leading source of visitors to Australia for two years in a row.

Impact of the Coronavirus on Chinese Tourist Expenditure

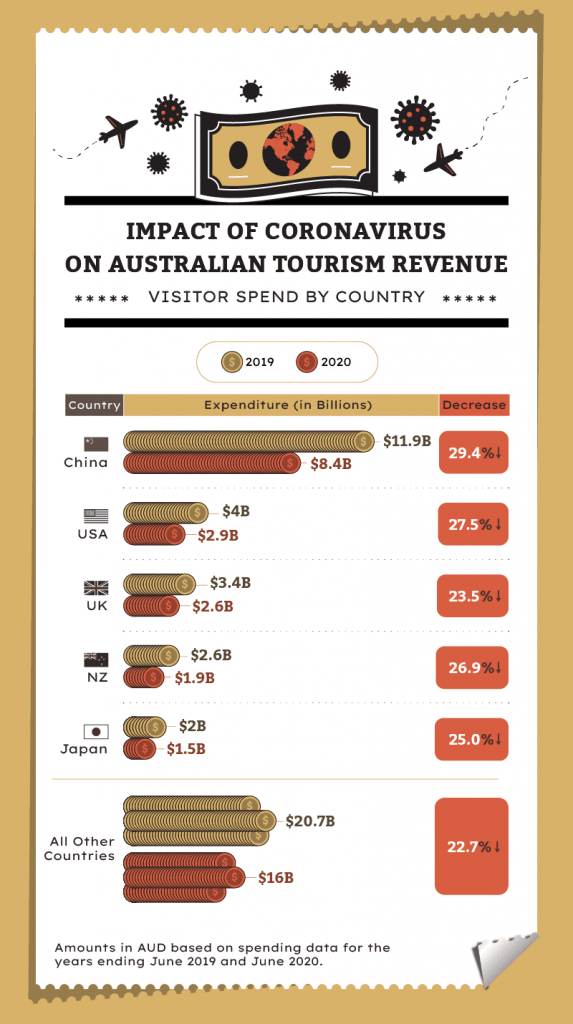

Chinese Tourists spent a total of $ 8.4 billion during trips to Australia for the year ending June 2020.

- Spending was down 29.4% when compared with the $11.9 billion of the previous year.

- Due to a larger spend on education, Chinese visitors have historically been the highest spenders during visits to Australia.

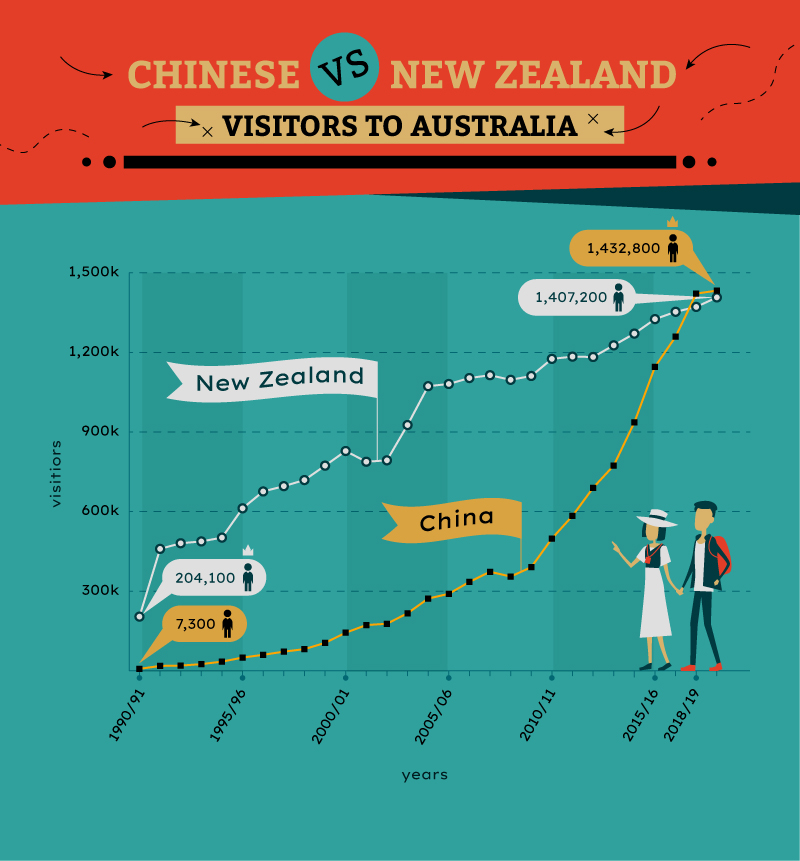

Growth in Chinese visits to Australia

- The majority of growth in Chinese visitors has occurred in the last decade and is driven to a significant degree by a steady increase in the number of Chinese students in Australia.

- In 2017/18, China became the top source of international visitors to Australia, overtaking New Zealand.

Data source: ABS. Image credit: Camper Champ

- The potential for further growth is still significant since, as of 2019, only 13% of Chinese residents owned passports, compared to 70% of New Zealand residents.

- Chinese visitor growth slowed down in 2018/19. The number of Chinese tourists to Australia grew by only 0.8% that year, compared to 12.9% in 2017/18.

Why did Chinese visitor growth to Australia slow down in 2019?

The number of Chinese tourists to Australia grew by only 0.79% in 2018/19, compared to 12.9% annual growth in the previous year.

This slowdown has been attributed to:

- a slowing of the Chinese economy2

- the ongoing US-China trade dispute

- a growing number of attractive alternative educational options for Chinese students, including New Zealand, UK and Canada.

China’s share in the Australian tourism industry

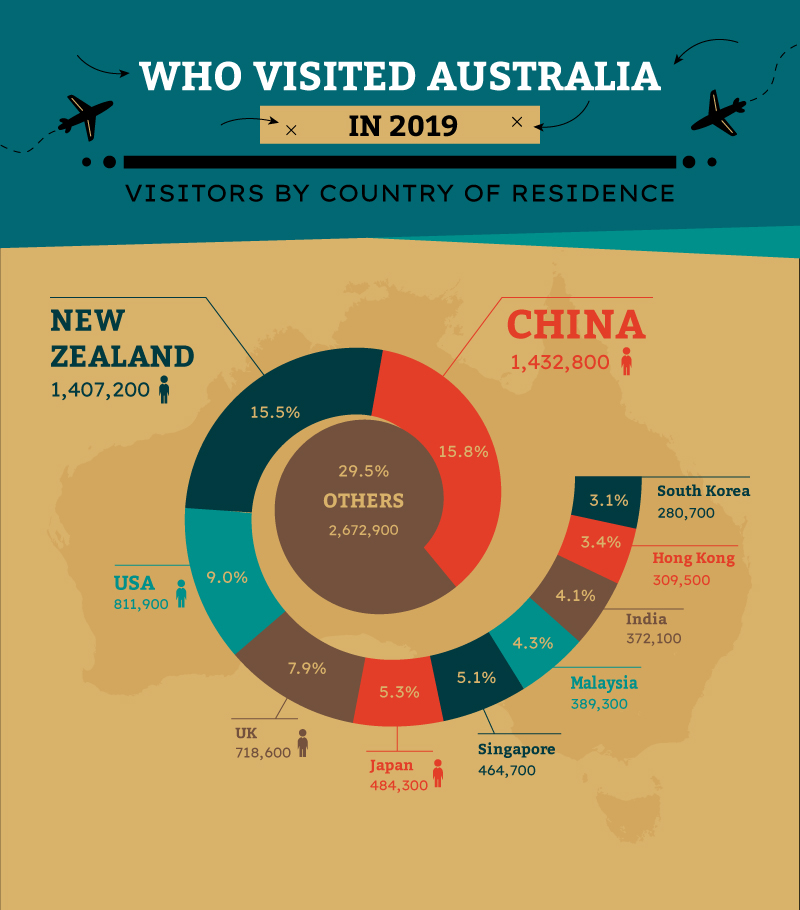

- China and New Zealand together contribute over 30% of visitors to Australia.

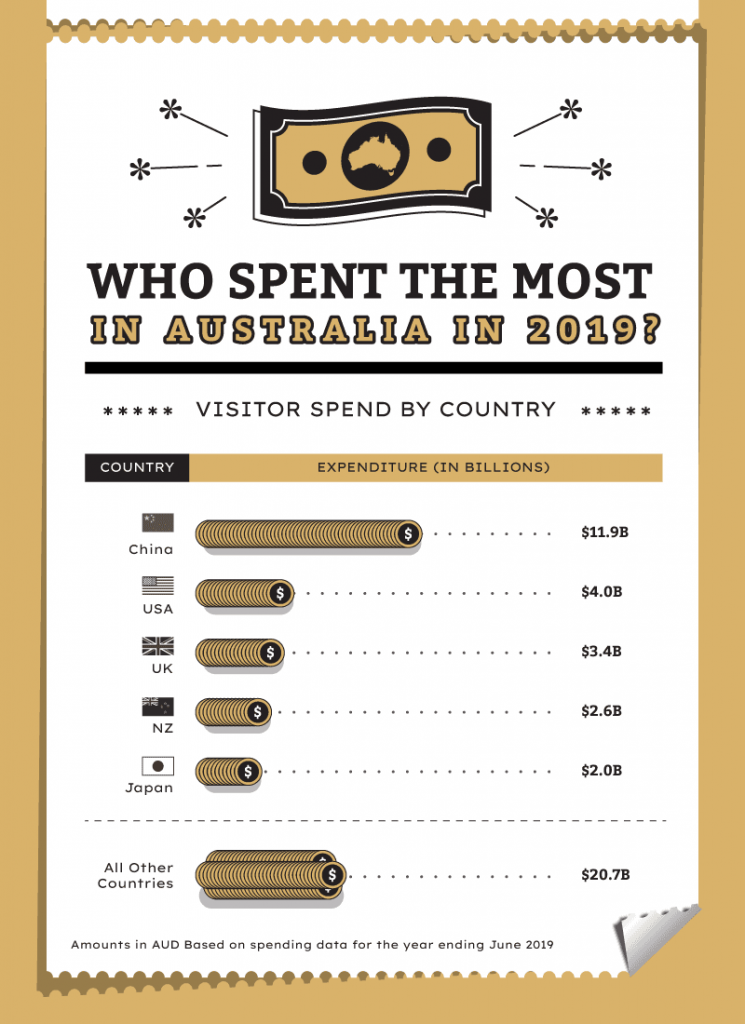

Top countries that sent visitors to Australia in 2019

China’s contribution to tourism expenditure in Australia

- At $11.9 billion in 2018/19, China accounted for more than 26% of all expenditures from international tourists in 2018/19 — three times more than the next-largest Australian tourism spenders: Americans. 3

Data source: TRA. Image credit: Camper Champ

Top Chinese Travel Trends in 2019

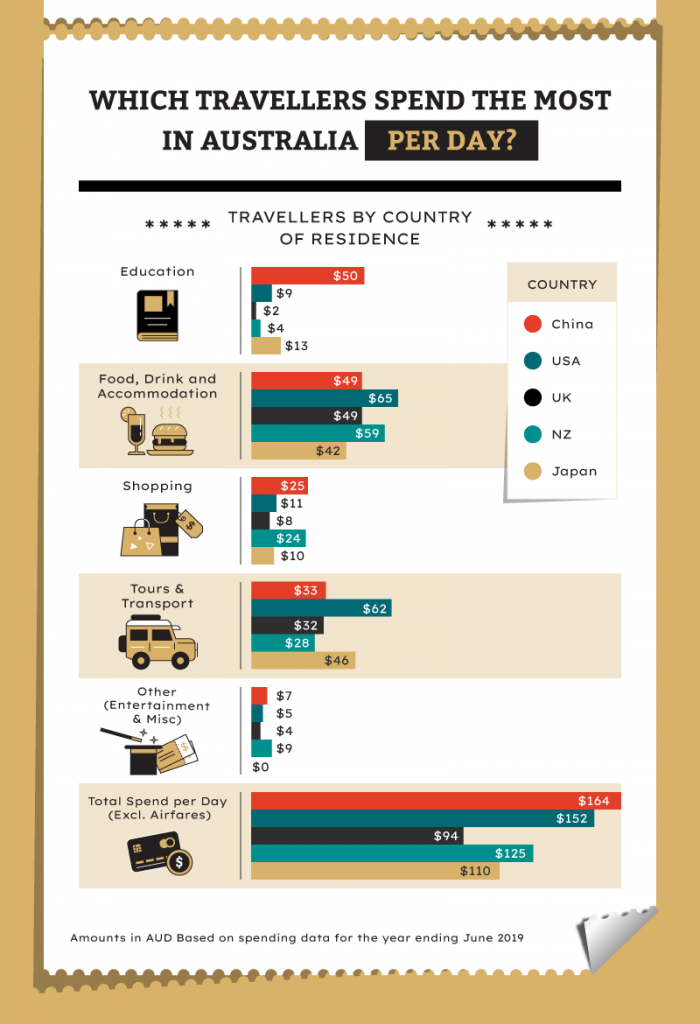

What do Chinese tourists spend on in Australia?

- When airfares are excluded, Chinese visitors spend the most per day in Australia, with above-average spending on education and shopping and slightly below-average spending on tours and transport.

Data source: TRA. Image credit: Camper Champ

China’s Capability to Travel

- Because of its sheer size and population, China is among the top international tourist sources for many countries, including Australia.

- Between 2009 and 2018, Chinese travellers made over 1 billion international trips as per data from COTRI, of which 160 million trips were made in 2018 alone.

- Around 13% (which translates to 180 million) of mainland residents have passports, making China the top potential source of international travellers.4

- The low percentage is also indicative of the massive and unmatched future potential of China as a tourist source, as a much higher proportion of the population is expected to get passports in the coming years.

Chinese Travellers’ Top Destinations

- As per available data from COTRI, the top 10 international destinations of Chinese travellers are Hong Kong, Macau, Thailand, Japan, South Korea, Vietnam, Singapore, the US, Italy, and Malaysia.

- Australia currently does not feature in the top 10 international destinations for the Chinese, yet earns its maximum tourism revenue from the Chinese.

- A high proportion5 of Chinese international travellers have been travelling to Greater China (Hong Kong, Macau and Taiwan), but every year a growing number of tourists are choosing farther destinations.

Where Do Chinese Travellers Visit? Preferences within Australia

- Chinese travellers have shown a clear preference for visiting and staying in major cities as opposed to country towns.

- Around 10-15% of the Chinese were found to have among the lowest regional dispersal (in terms of % of nights spent), as per 2012-2017 statistics.

- The three major reasons for this, as per a recent Tourism Research Australia report6, are:

- Perceived safety issues

- Lack of time

- Lack of information about regional Australia.

Travel Statistics Resources

References

- ABS: Overseas Arrivals and Departures, Australia, August 2019 ↩

- Bloomberg: China’s love affair with Australia fizzles ↩

- TRA: International Visitor Survey ↩

- COTRI: One billion trips in a decade ↩

- Telegraph: Rise of the Chinese Tourist ↩

- TRA: Regional Dispersal Report, October 2019 ↩

- Al Jazeera: Overreaction’: China students stuck as Australia closes border↩

- Tourism Tropical North QLD: CEO Statement on Coronavirus impact↩

- Al Jazeera: Overreaction’: China students stuck as Australia closes border↩

- Department of Health: Press conference at Parliament House about novel coronavirus↩

- TRA: International and National Visitor Survey, Australia, March 2024 ↩